Automotive Stainless Steel Tube Market To Be Driven By Rising Demand In Automotive Industry Till 202

From: http://www.digitaljournal.com/pr/3338736

The global automotive stainless steel tube market size was valued at USD 3.37 million in 2015 and is projected to grow at a CAGR of 3.9% from 2016 to 2024. Stainless steel has become one of the primary materials in the automotive industry on account of its high strength-to-weight ratio which helps in the overall weight reduction of the vehicle. Besides, good corrosion resistance & dent performance, coupled with high durability, have increased its demand in this industry.

Growing automotive industry is expected to be the major driver for the market. Other factors such as stringent regulations regarding vehicle safety and fuel economy in order to increase the strength of the vehicle, and at the same time, reduce its kerb weight, are expected to propel growth.

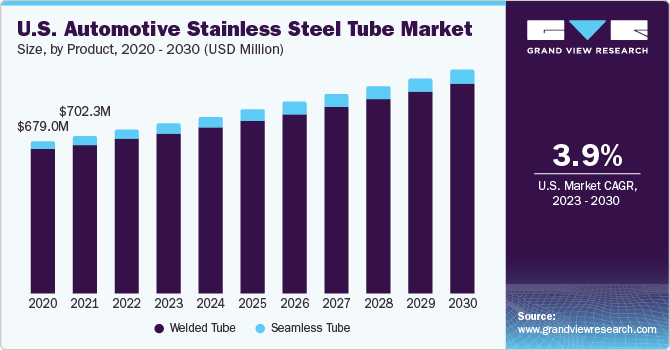

U.S. automotive stainless steel tube market, by product, 2013-2024, (USD Thousand)

To learn more about this report, request a free sample copy

Growing demand from emerging economies such as China and India is projected to boost the industry over the forecast period. Besides, government-backed schemes & foreign investments, ingenious marketing strategies, and recovery of economies have also provided the necessary momentum to the industry.

Product Analysis

Welded and seamless were the two main product types of stainless steel tube used in the automotive application. Welded tube is manufactured by welding the seam on the tube. Seamless products do not have a longitudinal weld seam and hence, do not crack or leak.

As seen in the figure, the product segment was dominated by welded tube in 2015. They accounted for more than 95% of the market. These are more readily available, which results in minimum waiting period, consequently, making them cost-effective. Their wall thickness is more consistent as compared to the seamless product type. Besides, they can withstand extreme temperatures and pressures, making them ideal for critical automotive components such as exhaust systems.

Global automotive stainless steel tube market, by product, 2015 (%)

To learn more about this report, request a free sample copy

The seamless stainless steel tube is projected to grow at the highest CAGR of 7.9% from 2016 to 2024. Since there is no welding, their corrosion resistance is very high. However, they are not as widely used as welded products on account of high cost.

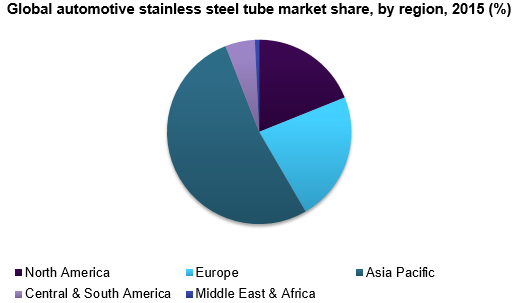

Regional Insights

Asia Pacific was the largest market for automotive stainless steel tube in 2015 with a share of more than 50%. This region is driven by its booming automotive sector, which has resulted in growing demand for both, welded as well as a seamless stainless steel tube. This is also projected to be the fastest-growing region over the forecast period.

The North American automotive stainless steel tube market was dominated by the U.S. in 2015. Welded tube held the largest share in this region, while the seamless products are projected to grow at the highest CAGR from 2016 to 2024.

North America is home to some of the major automobile manufacturers such as Ford Motors and General Motors. Other European and Asian automotive manufacturers such as Volkswagen, BMW, Honda, Hyundai, and much more operate in this region.

Europe, which held the second largest share in 2015, is projected to be the second-fastest growing region in this market, over the forecast period. Countries such as UK and Germany have witnessed increased demand for these products, courtesy growing automobile industries.

Competitor Insights

The industry is highly consolidated owing to presence of both, small and large scale manufacturers throughout the world. Sandvik Group, Nippon Steel & Sumitomo Metal Corporation, ArcelorMittal, ThyssenKrupp accounted for the majority of services in the market.

Tubacex, Handytube Corporation, Plymouth Tube Company, Fischer Group, Maxim Tubes Company Pvt. Ltd., JFE Steel Corporation, ChelPipe, Penn Stainless Products Inc., Bri-Steel Manufacturing, and Centravis are other well-known global names in the industry.

These players adopted organic and inorganic strategies such as mergers & acquisitions, expansions, new product developments, and agreements, collaborations & joint ventures in order to expand their product portfolio, geographical reach, and consequently, increase their shares.

In August 2015, Sandvik Group launched the Pressurfect series of stainless steel tube that are used for GDI (Gasoline Direct Injection) fuel systems. This range was designed to handle high pressures and also delivered weight reductions by 40%.

In September 2014, ArcelorMittal unveiled Fortiform, a new range of steel products for the automotive industry. This range offered significant safety improvements to vehicles while reducing the weight of the vehicles. This expanded the company’s existing product portfolio.

Report Scope

| Attribute | Details |

| Base year for estimation | 2015 |

| Actual estimates/Historic data | 2013 - 2015 |

| Forecast period | 2016 - 2024 |

| Market representation | Volume in Tons, Revenue in USD Million & CAGR from 2016 to 2024 |

| Regional scope | North America, Europe, Asia Pacific, Latin America & MEA |

| Country scope | U.S., UK, Germany, Japan, China, Brazil |

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors and trends |

| 15% free customization scope(equivalent to 5 analyst working days) | If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

English

English 中 文

中 文 Español

Español Português

Português Deutsch

Deutsch Türk

Türk Pусский

Pусский عربي

عربي 한국인

한국인 日本語

日本語