Crackdown on Steel Exports Without Paying VAT: Companies Fined Over Ten Million Yuan, Who Is Losing Sleep?

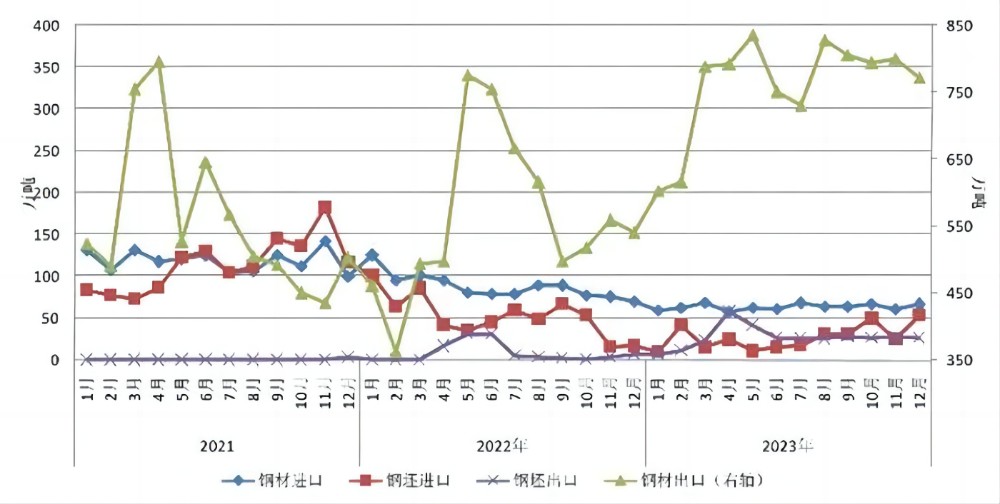

I. China's Steel Export Volume Hits Seven-Year High in 2023

On February 28th, the Institute of Metallurgical Industry Information Standards (hereinafter referred to as the Institute) released the "Analysis of China's Steel Import and Export in 2023", showing that China's steel exports reached 90.264 million tons in 2023, a year-on-year increase of 36.2%, reaching a new high since 2017, the fourth highest in history; steel imports were 7.65 million tons, a year-on-year decrease of 27.6%, the first time below 10 million tons since public data records began in 1995.

China's Steel Import and Export on a Monthly Basis

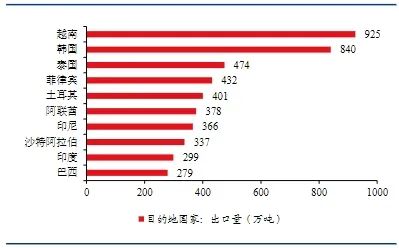

In terms of the destination of China's steel exports, there was a significant increase in Southeast Asia.

Top 10 countries in terms of steel export volume in 2023

In terms of the rise and fall of steel exports to different countries, the analysis by the Institute pointed out that the export volume of steel to India, the United Arab Emirates, Brazil, Vietnam, Turkey, Egypt, and Russia increased by more than 50% year-on-year, while exports to the United States, Canada, Italy, and Belgium decreased by 14%-30% year-on-year.

II. Low-priced Exports Give Rise to Tax Evasion

Exporting without paying VAT refers to fraudulent trade activities where entities or individuals without import and export rights use legal export customs clearance documents provided by other import and export companies with operating rights to conduct fictitious export transactions. These activities usually involve tax evasion, fee evasion, exchange control evasion, and document evasion, aiming to forge or purchase customs clearance documents of other import and export companies and conduct foreign trade exports in their names.

Since 2021, with the cancellation of most steel export tax rebates by the state, the entire steel market has turned from prosperity to decline, and global procurement has shifted from being concentrated in China to partially shifting to India, Southeast Asia, and other countries. The foreign trade export of steel has become increasingly difficult. At this time, some people take risks and use the exporting without paying VAT model to subsidize the country's 13% tax revenue loss, illegally and improperly obtaining overseas orders.

Exporting without paying VAT has frequently occurred in China over the years, but since the end of 2022, this situation has become very serious. The quantity of goods exported overseas has continued to increase, but they cannot enter mainstream regular factories. Exporting without paying VAT is stifling legitimate business, and no enterprise can compete with sellers who evade taxes and duties.

Since 2021, after the country canceled all export tax rebates for all types of steel, exporters no longer need to apply for export tax refunds from the tax authorities with invoices and export documents from upstream suppliers. Foreign recipients never need invoices from domestic exporters either, so domestic exporters have "goods that don't need invoices" on their hands, and these "invoices that don't need to be issued" can be issued to downstream users who "don't need goods but only need input invoices."

Downstream users can use low-priced purchase value-added tax invoices for input tax deduction without actually purchasing steel. Thus, everyone in the entire industry chain is happy, and each role earns some money—exporters make a few points selling tax invoices, downstream users who buy invoices without goods earn a few points of input tax deduction, and foreign recipients buy goods at low prices. But the only loser is our national tax revenue.

Article reproduced by a third party.

English

English 中 文

中 文 Español

Español Português

Português Deutsch

Deutsch Türk

Türk Pусский

Pусский عربي

عربي 한국인

한국인 日本語

日本語